There are a lot of numbers and terms used during the purchase process. When buying a home, it is common for mortgage brokers and lenders to refer to the “down payment” and for lawyers to refer to the “balance of funds required to close”. In this article we will discuss the difference between a “down payment” and the “balance of funds required to close” a real estate purchase.

A down payment is the amount of money that a client pays towards the purchase of their home. The amount is based on the portion of the purchase price being paid by the client versus the portion of the purchase price being paid by the client’s lender. For example, if the purchase price is $500,000 and the client is paying a 5% down payment, the client’s down payment is $25,000.

A minimum down payment is based on the purchase price. If the purchase price is:

- $500,000 or less, the minimum down payment is 5% of the purchase price;

- $500,000 – $999,999, the minimum down payment is 5% on the first $500,000 of the purchase price and 10% for the portion of the purchase price above $500,000; or

- $1,000,000, the minimum down payment is 20% of the purchase price.

If a client’s down payment is less than 20% of the purchase price, the client must purchase mortgage loan insurance (CMHC Mortgage Loan Insurance). This insurance protects the client’s lender in the event that the client does not make their mortgage payments. Mortgage loan insurance is deducted from the principal mortgage amount before the mortgage proceeds are deposited into the lawyer’s trust account.

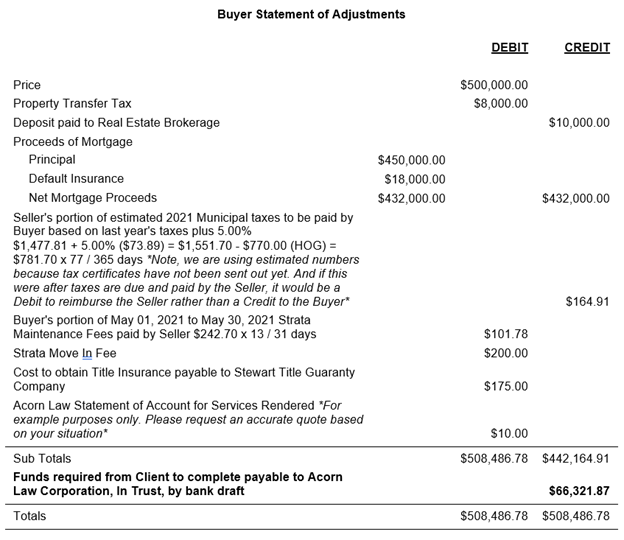

The balance of funds required to close a client’s real estate transaction is based on a document called the Buyer’s Statement of Adjustments. This document shows all of the money that needs to be paid (shown under the Debits heading) and all of the money that is coming in (shown under the Credits heading).

- Examples of money to be paid/Debits include things like the following (if applicable): the purchase price, GST, property transfer tax, strata move-in fees, reimbursements for prepaid property taxes, compliance deposits, title insurance, and legal fees.

- Examples of money coming in/Credits include things like: the deposit already paid by the client and mortgage proceeds (after CMHC insurance, appraisal fees, deposit fees, etc.).

- Examples of items that may be Credits or Debits depending on the timing and situation include adjustments for property taxes, utilities, strata fees, and rent paid by tenants. These amounts are calculated based on the proportion of the applicable period during which the buyer versus the seller owns the property (ie. the Adjustment Date in the Contract of Purchase and Sale).

We have included an example Buyer’s Statement of Adjustments below based on a purchase price of $500,000 and a down payment of 10% of the purchase price (ie. $50,000).

*Example for illustrative purposes only

You will notice that once all of the adjustments are done the amount required to close is actually $66,321.87 on top of the $10,000.00 deposit that was already paid. This means that the actual out of pocket expenses are $76,321.87, which is actually 15.26% (rather than the 10% down payment that was used for financing purposes).

The difference between the down payment and balance required to close (plus the deposit) is not always this large, but a large CMHC Mortgage Default Insurance premium and other adjustments can add up quickly! For that reason, it is prudent for clients to not only consider their down payment for financing purposes, but also the total balance that is required to complete the transaction when budgeting for their new home.

If you have questions about the above or real estate transactions in general, please do not hesitate to reach out to one of our lawyers practicing in the area of real estate law at (778) 940-3768 or info@acornlaw.ca.

Author: Danielle (Dani) Brito

This information is general in nature only. You should consult a lawyer before acting on any of this information. This information should not be considered as legal advice. To learn more about your legal needs, please contact our office at (778) 940-3768 or any of our lawyers practicing in the area of real estate law at the following:

Jennette Vopicka: jennette@acornlaw.ca

Danielle (Dani) Brito: dani@acornlaw.ca